The Wall Street Journal was on the money when it began a December 27 story with these words: “Beer had a rough year”.

There were, however, a few notable exceptions.

The Mexican import trio of Modelo, Corona and Pacifico continues to grow and this was an especially strong year for sales of Miller Lite, Coors Light and Yuengling as those brands were a beneficiary of the Bud Light boycott. The long-time industry leader has yet to recover from the marketing/management debacle of April. Despite that, Anheuser-Busch remains America’s largest brewer as Bud Light’s losses have been offset somewhat by the resilience of Michelob Ultra.

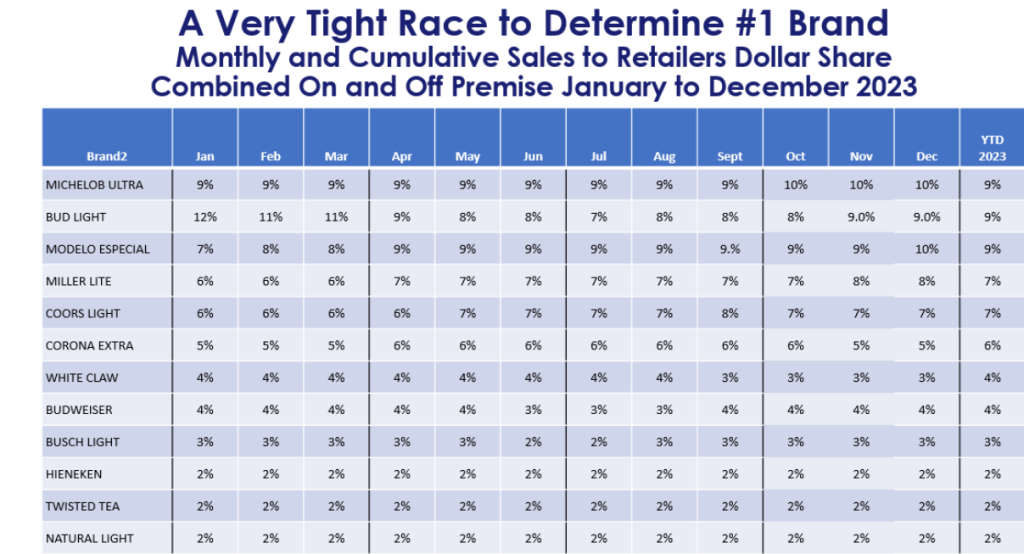

In fact, at year’s end, there’s a three-way tie for the #1 beer in U.S. among Michelob Ultra, Bud Light and Modelo Especial. Fintech data is a reflection of overall dollar sales in both the on- and off-premise sectors.

So, besides what happened with Bud Light, here’s why 2023 was such a rough year for beer.

Decreased Beer Volumes

U.S. beer shipments fell more than 5% during the first three quarters and, according to Beer Marketer’s INSIGHTS, will hit the lowest level in a quarter-century. Excise tax revenue is based upon volume sales to retailers. It’s a proven way to track what’s happening in North Carolina and, through November, beer tax collections were down 1.7%.

Consumer Shift

Beer remains the adult beverage of choice, according to an annual Gallup poll. 37% of drinkers say they drink beer most often while 31 % favor liquor and 29% prefer wine. There is, however, a generational shift afoot. Younger adults drink less alcohol than older consumers while leaning more toward non-alcohol offerings and cannabis, whether it’s legal or not.

The seltzer craze has slowed considerably, although White Claw has demonstrated long-term staying power. Canned liquor cocktails continue to build market share as High Noon is now the number 1 liquor brand in the U.S (Shanken News Daily).

Draft Beer Struggles

As Brewers Association chief economist Bart Watson said back in August, “Draft beer never really came back from the pandemic.” There’s been a decrease of more than 2 million barrels since 2020. While draft accounts for less than 10 percent of the overall beer sold in the U.S., it’s the proven way for brewers to build brands, curry interest and create loyalty with consumers.

End of Craft Gold Rush

It was not so long ago that craft beer sales were growing at a double-digit clip each year, but not anymore. U.S. production numbers are down and there’s more competition than ever with 9,000-plus craft brewers in the U.S. More than 385 breweries closed during 2023, compared to around 420 opening. That’s the closest-ever gap. Some craft brewers are struggling to pay off hefty bank loans and the brewing equipment resale market has been flooded with fermenters and canning lines now selling for a dime on the dollar.